Banks go bust! Historic 2023 financial meltdown

After the rough collapse of Silicon Valley Bank (SVB), First Citizens Bank, which is located in Raleigh, N.C., took over the financial company and will now be in charge of rebuilding the once flourishing company.

April 3, 2023

In early March, three large bank firms failed, occurring over a disastrous five day span. The first bank, Silvergate Bank, located in La Jolla, Calif., announced their closing on March 8. Two days later, Silicon Valley Bank, located in Santa Clara, Calif., announced the closing of their company on March 10, and finally, regulators closed Signature Bank on March 12, which is located in New York City, N.Y.

Silvergate and Signature Bank both mainly serve clients who deal in the cryptocurrency industry. On the other hand, Silicon Valley Bank is known in the tech startup world, especially with their involvement in the San Francisco Bay area.

All three of these banks closed down for the same reason: experts say that each of these banks experienced what is called a bank run, meaning that there were too many people withdrawing their investments from the banks, and the banks could no longer meet their financial obligations to their lenders.

This financial disaster not only cost individuals to lose all of their money but also businesses, especially the ones involved with Silicon Valley Bank, who were mostly startup companies.

People on social media and many companies didn’t know what the government was going to do as a response to this catastrophe. Finally, on March 13, the United States Department of Treasury gave depositors from Silicon Valley and Signature Bank access to all of their money and stated that, “no losses associated with the disaster will be borne by the taxpayer.”

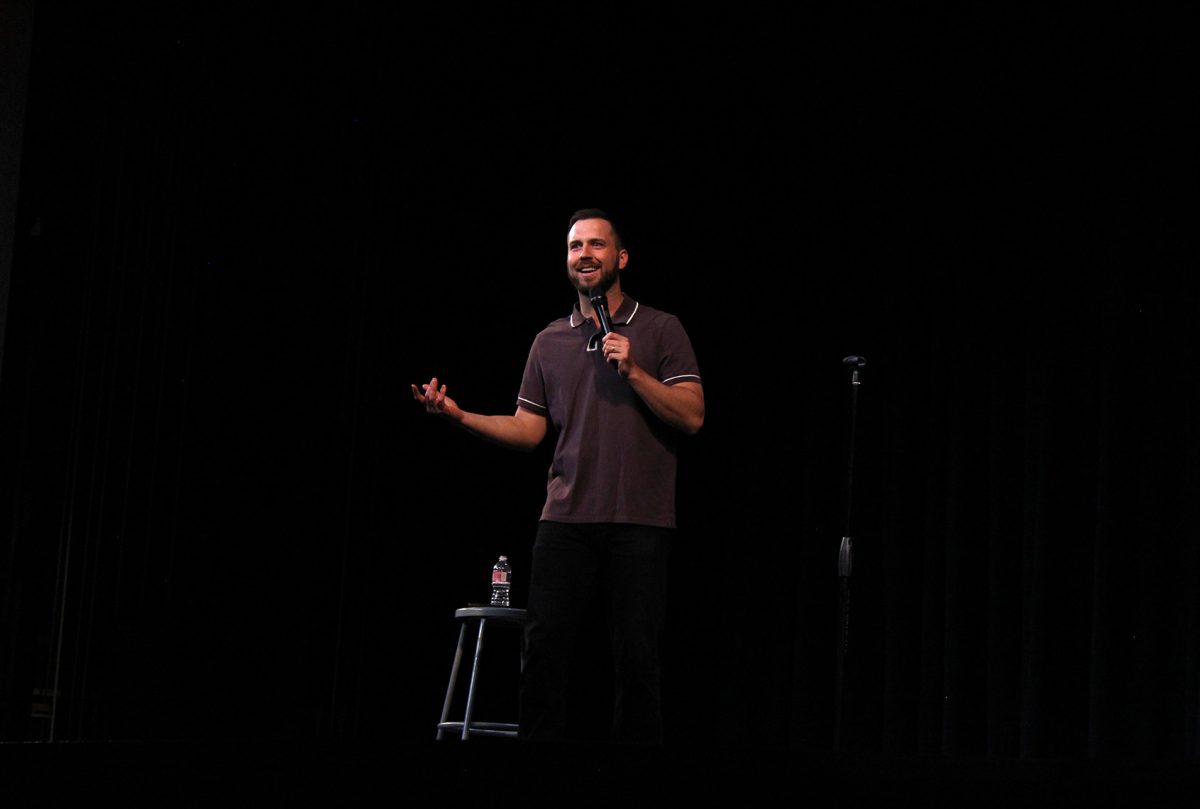

Jeff Lovett, AP Micro and Macroeconomics teacher at Edmond Memorial High School, spoke on this idea of whether the U.S. government should be involved in this situation.

“No, I don’t think this was a good move by the government, and here’s why. If you don’t allow businesses to fail, if you don’t allow banks to fail, essentially what you are doing is allowing these entities to privatize their profits and to push their losses off onto the public,” Lovett said.

Even though the government is lending a hand to these banks and trying to be of service to the companies who lost their investments, it creates riskier actions among these institutions. The idea is that banks are becoming involved in tighter and less stable businesses, knowing that if they do go under, the U.S. government will be right there to bail them out.

Giving these banks a second chance is important to ensure economic stability but maybe the government should have let these banks run their course. The head CEO of Silicon Valley bank, Greg Becker, already knew that his company was failing, so in order to make sure he did not lose his money, he sold $3.6 million worth of stocks nearly two weeks before the disaster.

Acting on these disasters by helping failing banks sends a sign from the government, telling U.S. citizens not to worry about their money and to keep money in the banks. All the while, the government uses citizens’ tax money to help bail out these failing banks, which does not help the average American, especially those in the middle class, instead it gives service to the CEO’s and heads of the banks. So then the question remains: what steps should be taken in the future to prevent these businesses from crashing again?

“The focus needs to be more on the consumer and the individual person with money in the bank over the bank itself,” Lovett said. “There needs to be a tremendous amount of clarity regarding policy action. It’s not that there shouldn’t be regulations, it’s that there should be clear, efficient regulations.”

So all in all, the main point that needs to be made is this: commercial banking companies need to create regulations that help out the average customer and not the banking officials.

Contact Ryan White at ruffdraftemhs@edmondschools.net